Mitt Romney's 47%

The “mainstream media” and everyone else is talking about the video posted by Mother Jones magazine yesterday. But Mother Jones is a “far-left” magazine out to get Mitt Romney. Can it be trusted?

The “mainstream media” and everyone else is talking about the video posted by Mother Jones magazine yesterday. But Mother Jones is a “far-left” magazine out to get Mitt Romney. Can it be trusted?

In this case we have the candidate’s own words—spoken to supporters at a $50,000-a-plate fundraising dinner—to speak for themselves. Here is the full text of Romney’s quote (emphases mine):[1]

There are 47 percent of the people who will vote for the President no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that’s an entitlement. And the government should give it to them. And they will vote for this President no matter what. And I mean the President starts off with 48, 49, he starts off with a huge number. These are people who pay no income tax. Forty-seven percent of Americans pay no income tax. So our message of low taxes doesn’t connect. So he’ll be out there talking about tax cuts for the rich. I mean, that’s what they sell every four years. And my job is not to worry about those people. I’ll never convince them they should take personal responsibility and care for their lives. What I have to do is convince the 5 to 10% in the center that are independents, that are thoughtful, that look at voting one way or the other depending upon in some cases emotion, whether they like the guy or not.

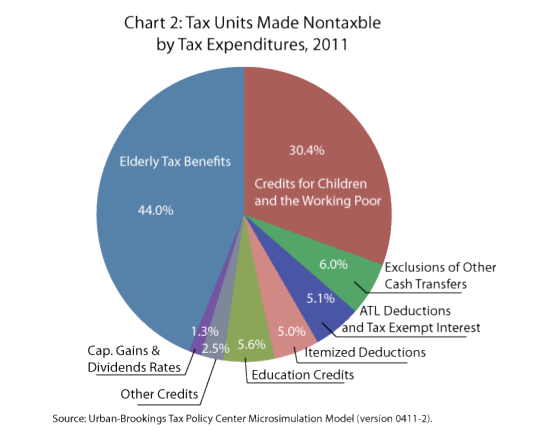

Why do 47 percent of Americans households pay no income tax? Here is a graphic taken from the Tax Policy Center/Urban Center/Brookings Institution study where Romney got his number. It explains who these households are:[2]

In this report, tax units are synonymous with households. This pie chart breaks down 2011 non-tax-paying households by the primary reason they paid none. As the graphic shows, the largest percentage of these (44%) were the elderly. Most of these elderly live on non-taxed Social Security income generated by taxes paid over the course of their working lives. The second highest percentage (30%) of households not paying taxes in 2011 were the “working poor” and those receiving credits for children. The remaining 25% of non-tax-paying households/units were mostly middle-class and above: those taking advantage of itemized deductions, educational credits, capital gains exemptions, etc.[3] Please read the full report if you are interested in understanding these numbers.

In this report, tax units are synonymous with households. This pie chart breaks down 2011 non-tax-paying households by the primary reason they paid none. As the graphic shows, the largest percentage of these (44%) were the elderly. Most of these elderly live on non-taxed Social Security income generated by taxes paid over the course of their working lives. The second highest percentage (30%) of households not paying taxes in 2011 were the “working poor” and those receiving credits for children. The remaining 25% of non-tax-paying households/units were mostly middle-class and above: those taking advantage of itemized deductions, educational credits, capital gains exemptions, etc.[3] Please read the full report if you are interested in understanding these numbers.

Who are the people who Romney doesn’t worry about because he will “never convince them they should take personal responsibility and care for their lives?” Maybe he was thinking of the group that makes up 30% of the 47% of Americans who paid no income tax in 2011? But math tells us that this group makes up only about 14% of American households (14 is 30% of 47). This number includes, in the words of the TPC report, the working poor: people who pay the payroll tax but at the end of the year have earned so little that standard deductions wipe out their tax burden. They receive a refund check that covers the full amount of their withheld taxes.

Some of you may remember working hard and falling into that tax bracket. I do. It would certainly have offended me to hear a Presidential candidate claim that I was dependent upon government and believed that I was a victim. That I was a person who could never be convinced to take personal responsibility and care for his own life.

~~~

Romney attempted to explain his remarks. In a press conference held yesterday he

- said that the people it is his job “not to worry about” are those who will support the President no matter what, not those who pay no taxes

- claimed that his remarks would be understood differently if they were heard in the context of the question to which he was responding

- stood by his statement that his message of lower taxes would not connect with those who pay no taxes

As for the first of these statements, we can judge for ourselves from his own words who he was talking about when he said, “My job is not to worry about those people. I’ll never convince them they should take personal responsibility and care for their lives.” He had already made very clear who these people are.

And the claim that his remarks were not heard in the context of the question to which he was responding? I would very much like to hear the question that would make these remarks any clearer or less offensive.

Lastly, what about the statement in the video that he does stand by? He concedes that those who pay no taxes will (of course!) not connect with his message. This may be the most important thing we can learn from this incident. In stump speeches he claims that his plan to lower taxes will stimulate the economy, create jobs, and benefit everyone.[4] Behind closed doors—and now in public—he says that this message will not appeal to those who already pay no taxes. He doesn’t say if it is because they will not benefit from his plan, or that they are just too ignorant and lazy to understand why lower taxes might benefit them.

Which is it?

Mitt Romney seems to think that the number of Americans who either will not benefit from his plan or are too ignorant and lazy to understand why they will is 47 percent!

—

Notes

- Watch the video yourself on YouTube. [^]

- The number given in the report is 46.4%. Apparently 47% is the projection for 2012 (I don’t have a source for this). See the PDF copy of their full report. [^]

- According to the report, one percent of those earning $1 million or more in 2011 paid no taxes. [^]

- Romney claims he will lower taxes without raising the deficit. He plans to do this by making unspecified spending cuts. [^]